Leaving Your Business Legacy

Part 1: How Roofing Contractors Can Successfully Exit Their Business

Angie Lewis, WriterYour retirement — traveling the world, relaxing on a beach, fishing, golfing, spoiling your grandchildren... However you want to spend it, you’ve earned your leisure time. On the other hand, what if you didn’t have enough money for that freedom of possibilities?

You work most of your adult life growing your roofing company to set yourself up for a comfortable retirement. When the time comes to transition the business, many questions may arise as you prepare to take that next step, such as:

- How can I take this success with me when I leave?

- How do I cash out without being clobbered by taxes or changing my lifestyle?

- How far ahead should I plan for my eventual departure from the company?

- What are my options for perpetuating my company’s legacy?

Finding the answers those questions is a process called exit planning.

Two of the best experts in the country agreed to share their insights into creating an exit plan that can secure your financial future.

Kevin Kennedy, CEO of Beacon Exit Planning, has firsthand experience with the challenges that come with buying and selling a business. Kennedy and his two co-owners sold their 63-year-old roofing company to the business’ fourth-generation team. Making a few financial mistakes during the sale, and realizing he didn’t have a solid understanding of the technical aspects of exit planning, Kennedy put himself through two years of school to learn everything he could. During that time, he met an “extremely talented tax guy” who would later become his business partner.

Joe Bazzano, COO of Beacon Exit Planning, is a certified public accountant, certified valuation analyst and certified business exit consultant with more than 25 years of experience. His areas of expertise include financial reporting, consulting, business valuations, mergers and acquisitions, exit strategies, and tax planning and compliance for individuals and business entities in various industries including construction, manufacturing, wholesale and personal service businesses.

In the first of this three-part series — which will also include practices for succession planning and contingencies — we’ll explore why you need an exit plan, common mistakes people make during the process and best strategies for preserving your business legacy.

What Is An Exit Plan?

An exit plan, Kennedy explains, “is a necessary tool that will assist a business owner in controlling and visualizing the process of transferring and monetizing the business while getting a better understanding of the financial aspects of the transaction.”

One of the first things to grasp is that most owners have 70 percent of their wealth trapped inside their illiquid business — meaning the business and its assets are not easily converted into cash.

“If you’re fortunate enough to be one of those owners who sell, you have Uncle Sam waiting for you with taxes that can range from 0 to more than 60 percent, depending on which state you live in, and depending upon how you exit,” Kennedy says. “It’s not easy. If you’re one of those people who doesn’t sell your company, you essentially have to liquidate it, which doesn’t make any sense because you end up with 10 percent of your wealth.”

During exit planning, Bazzano says they look at what he calls the three basic circles of a business owner’s life:

Business planning — protecting the business is critical

- Valuation

- Succession planning

- Tax ramifications

- Buy/sell risk management

Personal planning — the emotional side of the business/the legacy

- What’s the owner’s emotional attachment to the business?

- Is he/she really ready to leave?

- Are family members involved in the business?

Financial planning

- Identifying the liquid assets business owners need to survive/maintain their post-exit lifestyles

- Does the owner have enough money?

- Will he/she be on a fixed income after exit?

“When we analyze our clients’ businesses, what we see over and over again is that there’s a lack of coordination between a lot of these circles,” Bazzano says. “We look at the individual components, but we also make sure that the arrows are pointing in the right direction. The reason that's so important is, should something catastrophic happen before the transaction, it could lead to some significant negative consequences to the family or to the business itself.

“I can’t tell you how many times we’ve looked at companies and they may have a buy/sell agreement, but insurance may not be properly funded or they have insurance for estate-planning purposes and the beneficiary is not properly directed or it’s not owned properly. Insurance is a tax-free benefit. But if it’s aligned improperly, it’s a taxable event — which wasn’t the intention.”

Timeline

When should you start figuring out your exit strategy? As soon as you get into business, according to Bazzano. Instead, many owners — after devoting substantial resources to creating their business plan and budgets — spend more time planning their vacations than their exit.

“The reason they should start as soon as they get into business is to really understand what this business is, and understand the value and how to create value in the business,” Bazzano says. “Unfortunately, business owners aren’t doing that. They get too involved in the day-to-day business and aren’t addressing the issue of, ‘How do I grow value in this?’ Everybody’s thinking about today, not the future.”

Writing an exit plan can take an average of six months from the time you start and executing it may last from one to three years.

“What you don’t want to do is wait until you’re six months away from retirement and then decide that you want to start a plan,” Bazzano cautions. “That may work or it may not work — it depends on what you’ve done in the business. But typically, in that situation, it’s equivalent to a fire sale.”

Ways To Exit

Business owners have several exit options, including:

- Selling to an outsider (e.g., consolidator, investor)

- Selling to your employees/ESOP (employee stock ownership plan)

- Selling to your managers (manager buyout)

- Selling to your family

- Gifting your company

“The true value of a business is what somebody’s willing to pay for it,” Bazzano says.

However, roofing companies, by their inherent nature, typically have more risks associated with them than strategic value. When the markets or the economy take a big dip, contractors are among the first to suffer.

The most common sale in a roofing company is a manager buyout, according to Kennedy. "And that can take from eight to 12 years to execute because the company pays for everything," he explains. "They don't go to the bank and get the big loan — the company can't afford to do that. What they do is take their profits, and the profits pay for the owner's stock, which is then given to the managers.”

Common Mistakes And Strategies

Some common exit planning mistakes include issues with entity structure, taxes, improperly structured documents, not planning for catastrophic events, being underfunded with buy/sell agreements, and insurance and inaccurate valuations.

To avoid these pitfalls, work with an experienced professional who can educate and guide you through the process, making the experience as smooth and painless as possible. A pro can share exit-planning strategies that can save you a lot of money and headaches in the end.

One particularly important strategy to keep in mind, according to Bazzano, is to lessen your dependency on the business as an income source after you leave.

“It doesn’t always happen because business owners grow and reinvest in their business,” he explains. “But there’s nothing worse than being 65 years old and realizing that 92 percent of your wealth is in this business. Basically, you’ve reinvested everything and you’re completely dependent on monetizing this business as you try to retire. That’s pretty risky, as opposed to somebody who’s got maybe 20, 30 or maybe even 50 percent of their net worth in the business. So, taking some chips off the table really helps.”

Contractors should also know all of their options.

“A lot of times when we engage our clients and deliver a plan, one of the common comments we get is: ‘How come my attorney or my accountant has never told me this? I didn’t know this was available. I didn’t know I could do this,’” Bazzano says. “So, getting a good understanding of what your options are early on can really help you generate more value and lessen your exposure to financial risk down the road.”

When you start an exit plan, your goals – not the advisor’s – should be the driving factor behind how the exit strategy should evolve.

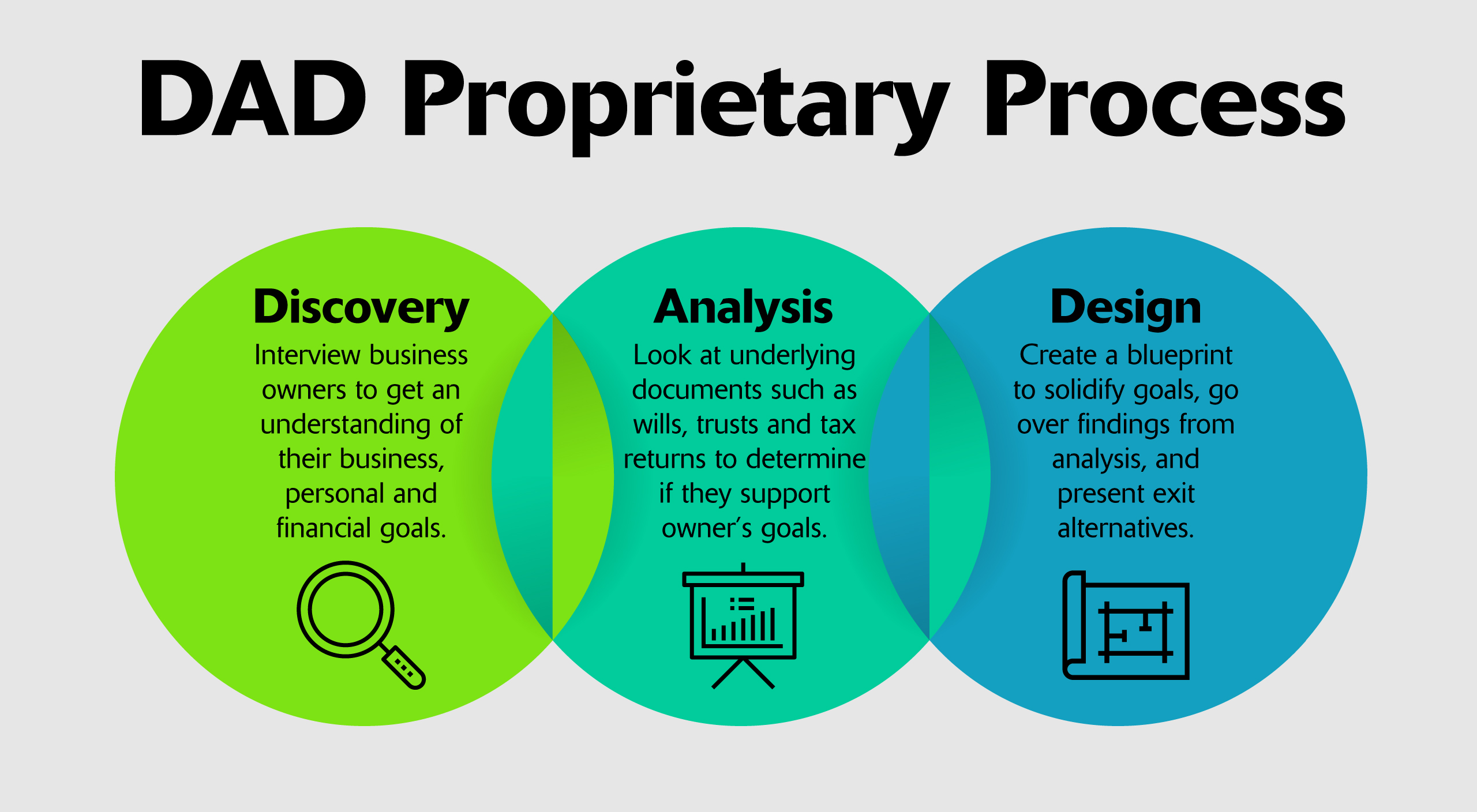

At Beacon, Kennedy and Bazzano use a proprietary process called DAD:

- Discovery — They spend a significant amount of time in this phase, which involves interviewing business owners to get an understanding of their business, personal and financial goals.

- Analysis — The analysis phase looks at underlying documents such as wills, trusts, buy/sell agreements, financial statements, tax returns and entity formation and evaluates whether they support owners’ intentions and goals.

- Design — This phase puts together a blueprint to solidify goals, goes over findings from the analysis phase and presents alternatives owners can use to exit.

“When we engage clients, we never tell them what to do,” Bazzano says. “The only thing we tell them to do is challenge us. They can challenge us as to why option A is more beneficial than option B. It’s an educational process. We always tell them, ‘We want to make sure you are 100 percent comfortable understanding the route you’re about to take and the decisions you’re about to make. But you need to make an educated decision.’ That’s our role during the process.”

Kennedy says the DAD plan can range from 50 to 120 pages. “It’s like being fed with a fire hose. But we always tell our clients that when we deliver the plan, it’s not the end — it’s the beginning.”

When it comes to exit planning, think of it as the first day of the rest of your life. Whether you’re just starting out or you’re a 30-year veteran, planning your exit strategy today can help prepare you and your company for the best tomorrow.

To learn more about Kevin Kennedy and Joe Bazzano, and for access to more in-depth information about the exit planning process, visit BeaconExitPlanning.com.